15+ Equity mortgage

Calculate your mortgage payment. A home equity loan gives you a lump sum of cash which you pay off with consistent monthly payments in addition to your current mortgage payment.

:max_bytes(150000):strip_icc()/average-what-can-i-expect-my-private-mortgage-insurance-pmi-rate-be.asp-d107c689ce61440b9ccc69363bbc08c0.png)

On Average What Can I Expect My Private Mortgage Insurance Pmi Rate To Be

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

. Build home equity much faster. People typically move homes or refinance about every 5 to 7 years. While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan.

Between February 2017 and September 2018 the BC Home Owner Mortgage and Equity Partnership program provided eligible home buyers a repayable down payment assistance loan that is registered on title of their home. To get cash in as little as 15 days i the stated income property and title information you provided in your loan. Locations Customer Support Fraud Center 724 625-1555 ONLINE BANKING.

Also check rates for home equity loans. Its Successors andor Assigns PO Box 961292 Fort Worth TX 76161-0292. With a 15-year fixed-rate loan you are likely to have to pay a higher monthly mortgage payment but you will pay far less interest over the life of the loan.

Buying a home has never been easier. No age requirement and must have at least 20 equity in the home. 15 Year Low Cost Fixed Rate.

If a person. For today Thursday September 01 2022 the national average 15-year fixed mortgage APR is 5220 up compared to last weeks of 5110. Mortgage rates valid as of 31 Aug 2022 0919 am.

Home Equity Savings and Mortgage Rates. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. We pride ourselves on providing competitive mortgage rates home equity rates and savings rates.

How much house can you afford. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. But just like other loans your mortgage insurance and tax costs can change over the years.

How can I update my mailing address. A homeowner can save money by paying off a 30-year mortgage in half the time without doubling his current monthly payment. You may call our office at 604-439-4727 on Monday-Friday from 830am-430pm.

30-Year Fixed-Rate Loans The primary advantage of a 30-year fixed-rate loan is that you can lower your payments to a more manageable level without having to take on a risky loan such as. 15-day timeframe is measured from the receipt of all requested documentation. Home equity loans are amortized at the beginning and each payment is divided between.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. A home equity loan is a second mortgage meaning a debt that is secured by your property. FNMA Purchase.

Mortgage Broker California and Arizona. ERATE is not affiliated with eRates Mortgage or Finance of America Mortgage. A 15-year fixed-rate mortgage comes with a monthly payment and interest rate that does not change for 15 years.

When you get a. 15 Year Low Cost Fixed Rate. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Find and compare the best rates for mortgage refinance home equity personal loans and auto loans. Also check rates for home equity loans.

Mortgage Home Equity Investments Retirement Home Auto Insurance Business Banking Routing 311981614. 295 Closing Cost 539 5. Must be at least 62 and own the home outright or have a small mortgage balance Home equity loan.

For example on the day this was written the average rate on a 15-year purchase mortgage was 2630 as opposed to that 3030 on a 15-year refinance. In fact the rates you see here are what youll actually get. If paying by online bill pay.

Check current BECU interest rates on mortgage loans ranging from fixed rate ARM construction government and more. Todays national 15-year mortgage rate trends. A home equity loan is a second mortgage for a fixed amount that is repaid over a set period such as 15 years.

Since 1900 Mars Bank is western Pennsylvanias one true community bank. Weve streamlined and updated the entire mortgage process to bring you a faster more technologically advanced way to finance your home. 15-year mortgage rates.

Fixed Rate Refinance 15 Year. A 30-year mortgage is amortized in a manner that requires larger interest. Borrowers who are new to automatic bill payments within Berkshire Banks online bill pay platform after November 15 th will need to select the payee Dovenmuehle Mortgage and provide your NEW loan account numberIf you do not know your NEW loan.

The length of the loan varies but 20-years is common. 295 Closing Cost 489 492 APR. Home Equity Loan interest rates and Home Equity Line of Credit Second Mortgage California California Home Equity Loans Second Mortgage at 5000 HELOC Rate.

If you dont receive your 1098 by February 15 you may request a copy from our automated service at 866-669-6607 available 247. You may also be able to access a copy of your 1098 by going to the Statements Documents tab for your active mortgage account in Online. Mortgage home equity and personal loans checking savings online and mobile banking.

A home equity loan can help. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Yes your mortgage payments are kept the same throughout the loan.

Compared to longer terms you get to pay down your debt and gain equity. News Insights. 5500 Star One Credit Union For banking by telephone to find an ATM or to speak to a Star One phone representative for assistance with this website please call us at 866-543-5202.

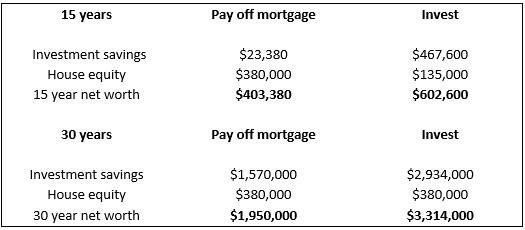

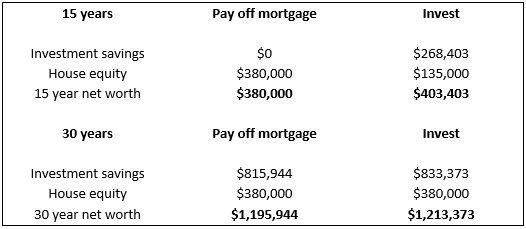

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

Home Loans Vermillion Fcu

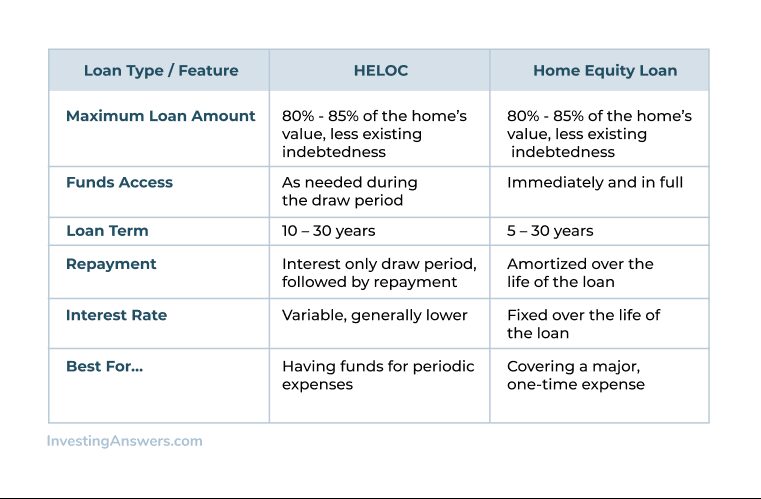

Heloc Vs Home Equity Loan What S The Difference Investinganswers

Second Home Loans And Vacation Home Loans Summit Credit Union

The Wealth Preservation Institute New Home Equity Acceleration Plan Smart Phone App

/business-with-customer-after-contract-signature-of-buying-house-957745706-c107ad59288c4de0b56d10315c08c67a.jpg)

How To Improve Your Chance Of Getting A Mortgage

The Home Equity Acceleration Plan Roccy Defrancesco Free Books

Second Home Loans And Vacation Home Loans Summit Credit Union

The Home Equity Acceleration Plan Book Wealth Preservation Products

Home Loans That You Can Trust Mortgage Loans By Herring Bank

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Amortization Schedule

Equity Archives Diligent Dollar

Annual Budget Templates 14 Free Doc Pdf Xls Printable Business Budget Template Excel Budget Template Budget Template

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

How To Tap Your Home Equity With A Home Listerhill Credit Union

The Home Equity Acceleration Plan Book Wealth Preservation Products